32. Impact investing: Capitalism created this mess. Capitalism has to fix it!

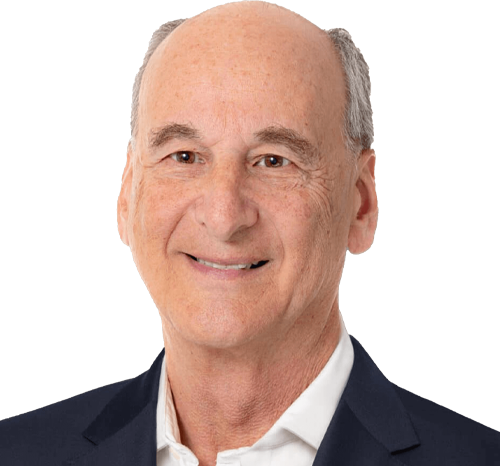

Bob Rosenfield was the CEO of the second largest company in the $4 billion US auto glass repair replacement and claims services market, and during that time he learned that “it isn’t as hard as you think to do the right thing and doing the right thing can be very good for business if you…

Read MorePodcast: Play in new window | Download